SentinelOne's Path To $40 Per Share

Why SentinelOne is heading to $40 by summer 2025

Executive Summary

I recommended SentinelOne to you 12 months back. In that time, the stock has been a material drag on DVR's performance.

The raging bull market clouds my judgment.

One part of me wants to say, that's not bad, nearly 20% in a year! But another part of me is more sober. This part recognizes this for what it is, a poor investment recommendation to you.

In hindsight, I believe I have work to do to improve my timing of when I recommend stocks. On the other hand, whether I admit this or not, the fact is that I make a lot of mistakes. All manner of mistakes. And SentinelOne has been a failed recommendation.

But what you care about is what's next? And here's why I am confident that I'm going to sell SentinelOne at $40 per share in summer 2025.

Updated Insights

I've spent a lot of time on Palo Alto Networks and CrowdStrike's recent earnings results.

And I'm reminded of the fact that out of all the cyber security names I could have chosen, I recommended to you the worst name.

This reminds me of the simple fact that being too early is the same as being wrong. In the market, you can't be too early. If I'm too early to recommend you an idea, you, the paying subscriber, are going to get bored and move on to more exciting and shiny story stocks. You may believe this statement to be inaccurate. But believe me, I know the game.

And what makes things even worse is that CrowdStrike's global IT outage incident provided SentinelOne with a very good catalyst, but yet, when it came to it, CrowdStrike was simply a superior business.

Next, to answer your main question of whether or not SentinelOne is now a buy allow me to say this.

It is evident that CrowdStrike's global outage has led to some small temporary ''make whole'' agreements and compromises with its customers, even though CrowdStrike attempts to brush this under the carpet.

But in the grand scheme of things, their customers understand the mishap and are more than willing to look beyond that incident. They value and trust CrowdStrike's Falcon platform.

And yet, it appears that Palo Alto has also benefitted from some churn away from CrowdStrike, as customers become more demanding of diversifying their IT infrastructure safety.

Therefore, I believe what I wrote to you last month about SentinelOne, that I'm going to sell SentinelOne at $40 per share by summer 2025.

Even though the stock has rallied a little since I wrote that statement 30 days ago.

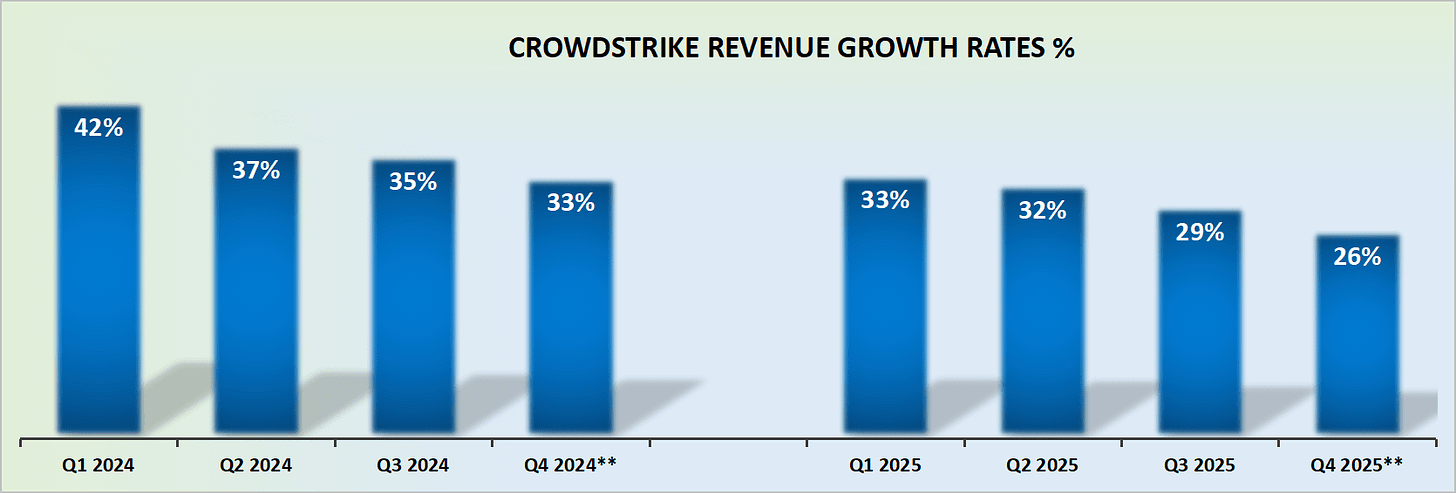

Furthermore, allow me to provide you with a little more context. Here's CrowdStrike's fiscal Q4 guidance:

The business just delivered its first sub-30% CAGR and the guidance for fiscal Q4 is decidedly sub-30%. For growth investors, once they are convinced that the business can no longer grow at more than 30%, the multiple on a company's stock starts to compress.

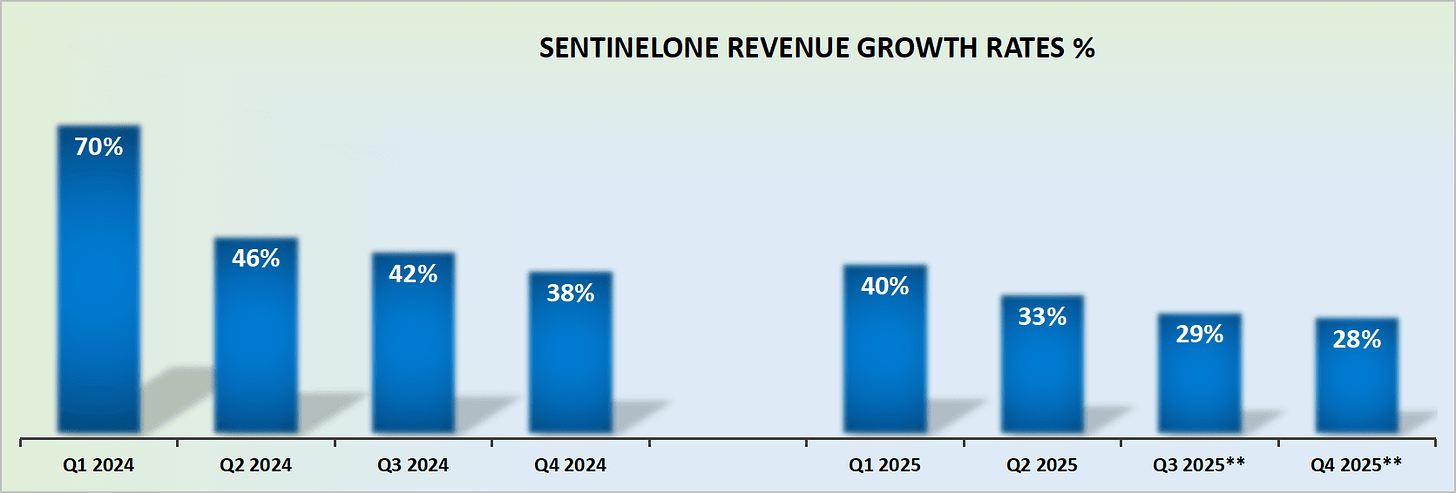

Next, I highlight for you SentinelOne. This is what I believe we are going to see next week.

I have very conservatively plotted SentinelOne's revenue growth rates for the next two quarters. Even though I'm fully expecting to see that when SentinelOne reports next Wednesday, they will upwards revise their Q4 2025 guidance (next quarter's guidance)

When that happens, investors are going to revisit SentinelOne as one of the leading +30% y/y revenue growth rates cybersecurity players.

Investors will cast their eyes beyond CrowdStrike to the next kid on the block.

Even though, when all is said and done, what I'm really looking forward to seeing is the evidence that the core of my SentinelOne thesis is accurate.

More specifically, that SentinelOne could be making more than $100 million of forward free cash flow starting fiscal 2026 (fiscal 2026 starts February 2025).

If investors start to buy into the idea that SentinleOne is able to be sustainably profitable after the next quarter, all of a sudden investors will look to its +$1 billion cash position with no debt in a very different light.

Because, as it stands, investors are not giving its +10% net cash to market cap position much value, as investors struggle to give this business enough credit, as they only view it as an unprofitable business.

But I believe the commentary on the earnings call next week will change that.

The Bottom Line

In my view, now is the time to buy into SentinelOne as it sets the stage for a significant turnaround.

The company is poised to demonstrate sustainable profitability by fiscal 2026, bolstered by strong revenue growth exceeding 30% and a cash-rich, debt-free balance sheet.

Once investors recognize SentinelOne’s ability to deliver over $100 million in forward free cash flow, the narrative will shift, and its valuation will reflect its true potential. I am confident that this momentum, paired with its improving fundamentals, will propel the stock towards $40 per share by summer 2025.