Investment Thesis

DraftKings (DKNG) is a business that I couldn't be happier to own. Not only has its share price held its ground in the past month during the market's risk-off mood, but its share price has actually strengthened.

The bear thesis is straightforward. Investors are worried that higher betting taxes will impact DraftKings' near-term prospects. Meanwhile, as you can see in this analysis, not only is DraftKings growing at a very fast rate, but its free cash flow is growing even faster.

I make the case that paying 26x forward FCF for DKNG is a steal and that this stock is headed for $65 per share by summer 2025.

Simple, Clear Instructions

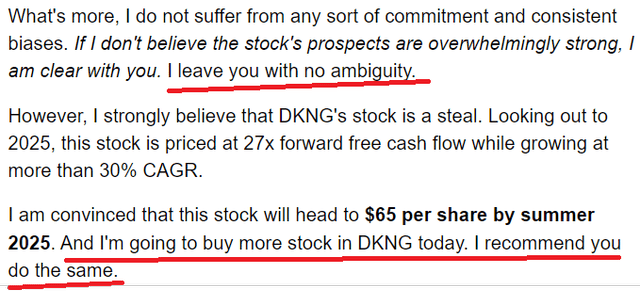

On 2 August, I said:

I would like to believe that I've always been crystal clear with you, both in the bad periods and the good periods.

Since I wrote that unequivocal recommendation the stock is up more than 10% in the past month.

Has it been all rosy since I first recommended DKNG to you 10 months back at $34 per share? It has not. No way.

This is again one of those instances which I was too early to recognize the company's upside potential. But at the same time, keep in mind, that while the rest of the market has become decidedly in risk-off sentiment, DKNG has continued to keep and grow its valuation.

This is the power of having a diversified portfolio.

Keep reading with a 7-day free trial

Subscribe to Deep Value Returns to keep reading this post and get 7 days of free access to the full post archives.